How To Use Gdp Deflator

What is Gdp Deflator?

The GDP deflator measures the change in the annual domestic production due to changes in price rates in the economic system. Hence, it measures the modify in nominal GDP and real GDP during a item year calculated by dividing the nominal Gdp with the real GDP and multiplying the resultant with 100.

Information technology measures price inflation/deflation concerning the specific base yr. Information technology is non based on a fixed handbasket of goods or services but can be modified yearly depending on consumption and investment patterns.

The GDP deflator of the base yr is 100.

Formula of Gdp Deflator

Where,

- Nominal Gross domestic product Nominal GDP (Gross Domestic Production) is the adding of annual economic production of the entire state's population at current market prices of goods and services generated past iv main sources: land appreciation, labour wages, upper-case letter investment interest, and entrepreneur profits calculated only on finished goods and services. read more = GDP evaluated using that current market prices

- Real GDP = Inflation adjusted measure of all goods and services produced past an economy in a year

How to Calculate GDP Deflator?

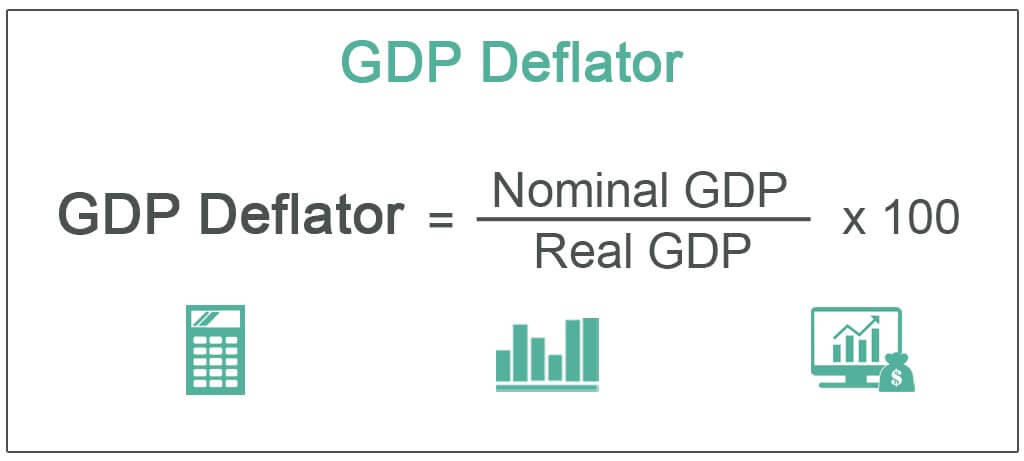

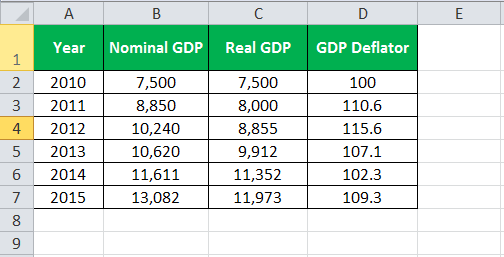

Here, we have used the following data to calculate this formula: –

| Year | Nominal Gdp | Real Gdp |

|---|---|---|

| 2010 | seven,500 | 7,500 |

| 2011 | 8,850 | 8,000 |

| 2012 | 10,240 | 8,855 |

| 2013 | ten,620 | ix,912 |

| 2014 | 11,611 | xi,352 |

| 2015 | 13,082 | 11,973 |

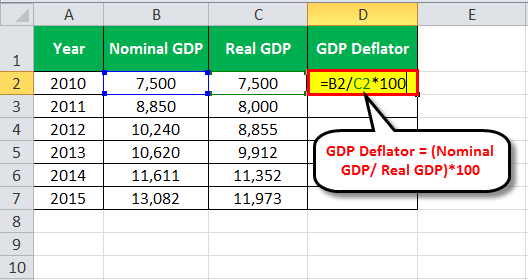

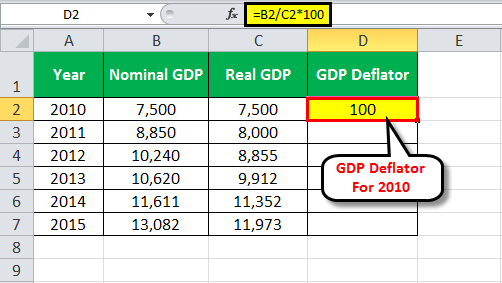

In the template below, we have calculated this deflator for 2010 using the formula mentioned in a higher place of GDP deflator.

And so, the GDP deflator calculation for 2010 volition be: –

Similarly, we have calculated the Gdp deflator for 2011 to 2015.

Therefore, the Gdp deflator calculation for all years volition exist: –

Nosotros can discover that the deflator is decreasing in 2013 and 2014 compared to the base year of 2010. It indicates that the aggregate price levels are smaller in 2013 and 2014, indicating the impact of inflation on Gross domestic product, measuring the cost of inflation/deflation compared to the base of operations year.

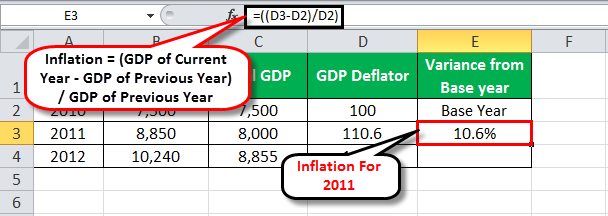

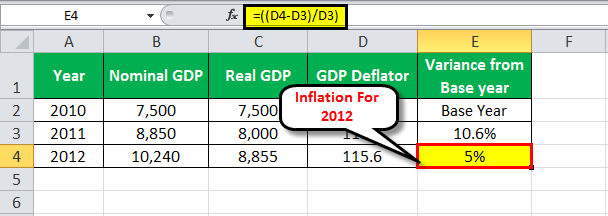

The GDP deflator can also be used to calculate the inflation levels with the below formula: –

Inflation = (GDP of Electric current Yr – Gdp of Previous Twelvemonth) / Gdp of Previous Year

Extending the above case, we have calculated 2011 and 2012.

Aggrandizement for 2011

Inflation for 2011 = [(110.6 – 100)/100] = 10.6%

Inflation for 2012

Inflation for 2012 = [(115.vi – 110.half-dozen)/100] = 5%

The results highlight how the full general toll of all goods and services fell from 10.6% in 2011 to 5% in 2012.

Importance

Though measures like CPI (Consumer Price Index) or WPI (Wholesale Price Index The Wholesale Toll Index tracks the price motion of products in a set territory and wholesaler jurisdiction. Wholesalers provide, manage, and command commodities, usually commonly traded appurtenances, before they are sent to retailers. read more than ) exist, the GDP deflator is a broader concept due to: –

- Information technology reflects the prices of all domestically produced goods and services in the economic system compared to CPI or WPI since they are based on a express basket of appurtenances and services, thereby not representing the unabridged economy.

- It includes prices of investment appurtenances, regime services, and exports while excluding costs of imports. WPI, for instance, does not consider the service sector.

- Important changes in the consumption patterns or introduction of new appurtenances or services are automatically reflected in the deflator.

- WPI or CPI is bachelor every month, whereas deflator comes with a quarterly or yearly lag after GDP is released. Thus, monthly changes in inflation cannot be tracked, which impacts its dynamic usefulness.

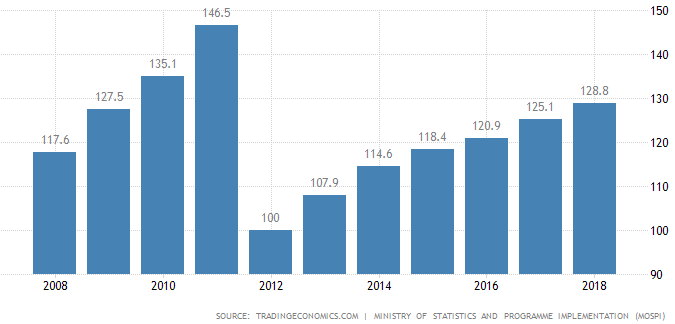

Applied Instance – Gdp Deflator of India

The below graph shows the Gdp Deflator of the Indian Economy:

source: Tradingeconomics.com

As can exist seen, the GDP deflator is steadily increasing from 2012 and is at 128.fourscore points for 2018. A deflator above 100 indicates price levels existence college compared to the base of operations twelvemonth (2012 in this case). Inflation does not need to occur, simply one tin experience deflation after a period of inflation if prices are higher than the base twelvemonth.

- The in a higher place graph changed the base twelvemonth in 2012 to better reflect the economy by covering more than sectors. Before that, the base year was 2004-05, which must modify.

- Since India is a rapidly growing economic system with dynamic changes to its policy, the mentioned changes were essential. Besides, the increasing deflator reflects a steady increase in aggrandizement due to continuous growth opportunities.

- As per Globe Bank reports for 2017, India ranks 107 for the listing of Gdp deflators with an inflation rate of iii%. Withal, it is comfortable compared to countries facing hyperinflation Hyperinflation is merely an accelerated level of inflation that tends to quickly destroy the actual value of the local currency since there is a ascent in the cost of all products and services, and it causes people to lower their holdings in that particular currency every bit they opt to participate in strange currencies that are relatively more stable. read more than such every bit S Sudan and Somalia. On the contrary, it also does not come across the threat of deflation such as Aruba and Liechtenstein. Hence, it is important to continue it at manageable levels.

- The RBI has adopted the CPI equally a nominal inflation ballast. During 2016, the Gdp Deflator suggested that the land enter a deflation zone while CPI exhibits a moderately high aggrandizement level. Such situations can push the economy into deflation, implying that corporate earnings and debt servicing ability closely runway nominal GDP volition deteriorate. In contrast, inflation-adjusted Gdp (Real GDP) may proceed to exhibit a growth charge per unit above 7%.

Gdp Deflator vs CPI (Consumer Price Index)

Despite the presence of a Gross domestic product deflator, the CPI seems to exist the preferred tool used past economies for ascertaining the touch on of aggrandizement in the country. Therefore, allow us look at some of the critical differences between GDP deflator vs. CPI.

| GDP Deflator | CPI (Consumer Price Index) |

|---|---|

| Reflects the cost of all domestically produced appurtenances and services. | Reflects the toll of goods and services ultimately purchased past the terminal consumers. |

| It compares the price of existing produced goods and services against the price of the same goods and services in the base of operations twelvemonth. This makes the group of goods and services used for GDP ciphering change automatically over time. | It compares the cost of the fixed basket of goods and services to the price of a handbasket in the base of operations yr. |

| It contains the prices of domestic goods | Imported appurtenances are also included in the same. |

| For instance, in the Indian economic system, the cost change of oil products is not reflected much in the Gdp deflator since domestic oil production is low in India. | As most of oil/petroleum is imported from Western asia, whenever the price of oil/petroleum production changes, it is reflected in CPI handbasket as petroleum products compute larger share within CPI. |

| Another instance is the ISRO satellite which shall reverberate in the deflator. | Assuming the price of ISRO increases, it would not be a part of CPI index as the state does not eat satellite. |

| Information technology assigns irresolute weights over fourth dimension as a composition of Gdp changes. | Assigns stock-still weights to prices of different goods. It'due south computed using a stock-still basket of goods. |

Recommended Articles

This article has been a guide to what GDP deflator is. Here, we discuss computing GDP deflator using its formula, applied examples, and importance. Nosotros also discuss GDP deflator vs. CPI. Yous may learn more about economic science from the post-obit articles: –

- Nominal Gross domestic product Formula

- (CPI) Consumer Price Index Pregnant

- GDP Formula

- Deflation vs Disinflation

How To Use Gdp Deflator,

Source: https://www.wallstreetmojo.com/gdp-deflator/

Posted by: ratliffpeammeak.blogspot.com

0 Response to "How To Use Gdp Deflator"

Post a Comment